Like other municipalities, Delran Township is not immune to the rising costs.

So how can Delran Mayor Gary Catrambone announce that the township is adopting a municipal budget with no tax increase – for the fifth year in a row – and a sewer budget that has no increase for the 15th consecutive year?

There is the “wonderful management from (Business Administrator) Joe (Bellina) and the administrative side and department heads … watching their pennies,” the mayor said at a May council meeting. “As everyone knows, we have a pretty healthy fund balance.”

The township is utilizing a $11.8-million surplus to help balance the budget.

“(That is) what (the funds are) intended to do in order to balance the budget each year,” Catrambone explained. “It would be a bad thing if (the fund) was depleting, but it’s not … “It is increasing ever so slightly each year, so therefore, even though we use more money, we are using a smaller percentage of the actual fund balance.

“It’s not a short-term trick,” Catrambone emphasized. “It is something that has been in effect for a long time and frankly puts Delran in the best financial situation ever in our history.”

Council adopted its 2024 financial plan, which totals $19.36 million, with the amount to be raised by taxation at $11.61 million, along with some state and federal funds and delinquent taxes.

The tax rate remains at 79 cents per $100 of assessed valuation, the same rate since 2020. Catrambone said the township has seen a lot of growth in the area, including along the commercial zone Route 130 corridor.

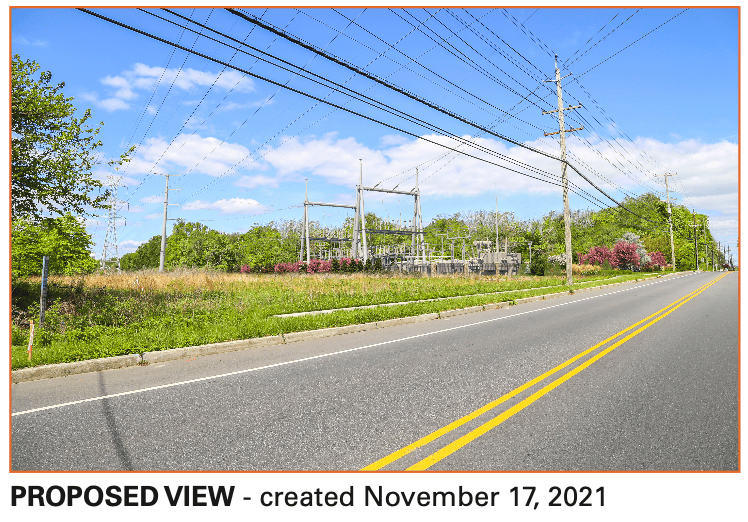

“Some of those new businesses are in the cannabis industry,” he noted, adding that PSE&G has made an “incredible investment in the town” by building a stronger infrastructure with the construction of the Rancocas substation on Hartford Road.

That gives the township more stability so it will not have to rely on the Cinnaminson or Willingboro substations for electricity. The Delran substation is operational and is expected to be fully completed by April 2025, officials said.

“This all supports our businesses, residents and the electric vehicles in the charging stations,” Catrambone pointed out.

He also said it’s important to know that the tax bill is divided, with 1% for open space, 4% for fire, 12% for the county; 20% for the municipality and 63% for the school board.

“So if a (resident) is paying 10,000 in taxes,” Catrambone added, “20% of that – or $2,000 – comes to the township.”