The Burlington County Board of Commissioners are reminding local small business owners and nonprofits that zero-interest loans are still available to assist them with their pandemic recovery.

“COVID-19 produced widespread and devastating impacts unlike anything most of us have ever experienced,” said Commissioner Deputy Director Dan O’Connell. “We’ve made great strides since last year, but we know many small businesses and nonprofit organizations are still struggling because of the fallout from the virus. We’re continuing to make loans available with zero interest to help these employers recover and grow again.”

Burlington County is offering the interest free loans through its Health Emergency Loan Program, or HELP. The program was created in 2020 in response to the pandemic and the economic fallout the crisis created and offers up to $50,000 loans to eligible small businesses that experienced pandemic-related hardship.

The loans are funded from $660,000 in federal CARES Act funding secured by the Burlington County Bridge Commission’s Economic Development Office.

The Bridge Commission is also responsible for administering the program.

Loans can be used for business-related purchases, payroll or other expenses or improvements. There are no closing costs, but sufficient collateral in personal or commercial property is necessary to secure the loan.

Five Burlington County businesses have received loans through the program to date and additional funds remain available.

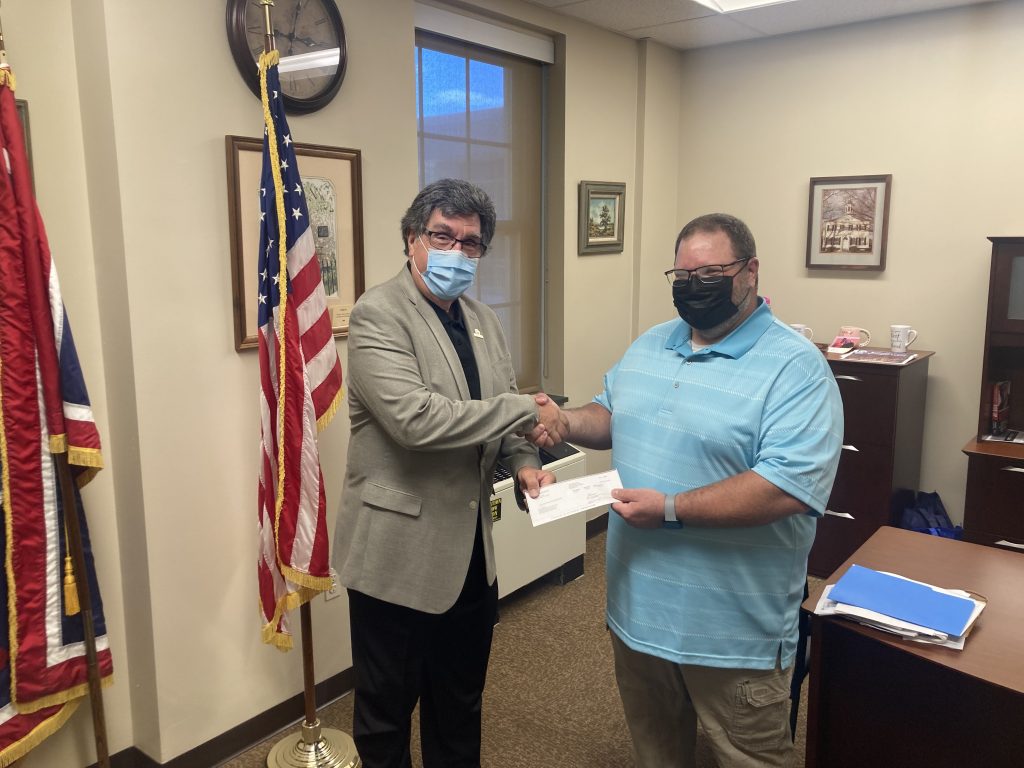

On Tuesday, O’Connell delivered a $45,000 check to Wayne Trojanowski, the owner of Hainesport-based South Jersey Lawns, the latest business to receive the county assistance.

The company has operated in Burlington County for 16 years and Trojanowski has lived in the county for 39.

“In 2020, like many small businesses, I took a hit and found myself in a hole that did not seem like I would be able to get out of. I found myself contemplating the future and sustainability of my business,” Trojanowski said. “With federal funds being taken up by larger companies, the smaller businesses like mine were left with an inbox full of ‘I’m sorry but you do not qualify emails.’ I was faced with having to borrow on high interest credit cards, which may have helped me now but ultimately would have sunk me as the interest on the debt would become overwhelming.”

He learned about the HELP loans program from a friend and was walked through the application process by Liz Verna, the County’s Director of Economic Development.

“As a business owner who faced the most challenging year of my life, as a husband and father whose family’s future is riding upon my shoulders, I cannot express how grateful I am to (Verna) and all who helped bring this program to Burlington County,” Trojanowski added. “This HELP loan will secure my business for years to come. I for one am proud to be a resident and a business owner in Burlington County and hope to be for many years to come.”

On Tuesday, he said business was picking up and that the HELP loan would provide him with the working funds to purchase materials and supplies to continue operations. He also encouraged more businesses to check out the program.

Additional program details and an online application are available at www.bcbridges.org/covid19-resources/

In addition to the HELP loans, Burlington County also offers zero-interest loans for businesses along the Route 130 corridor and low-interest gap loans for others throughout the county.

The County also just completed its second Restaurant Week promotion with a record 45 restaurants and eateries participating.

“Small businesses make up the backbone of our county’s economy and our communities so we need to do everything we can to help them rebound from a rough 2020,” O’Connell said. “HELP loans are one way our county can assist them, and we’re grateful for the work of Liz Verna and the Bridge Commission for securing the funding and administering this program. Restaurant Week and our Shop Burlington County First initiative are another way we’re trying to help. It’s especially important during times like these for all of us to pull together and support these businesses.”