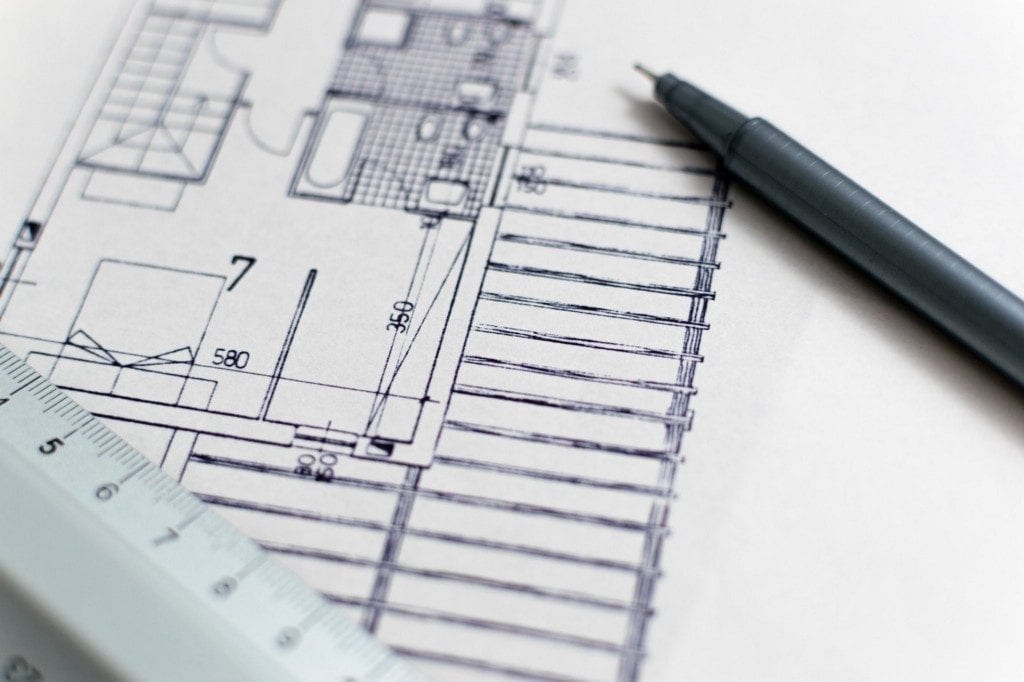

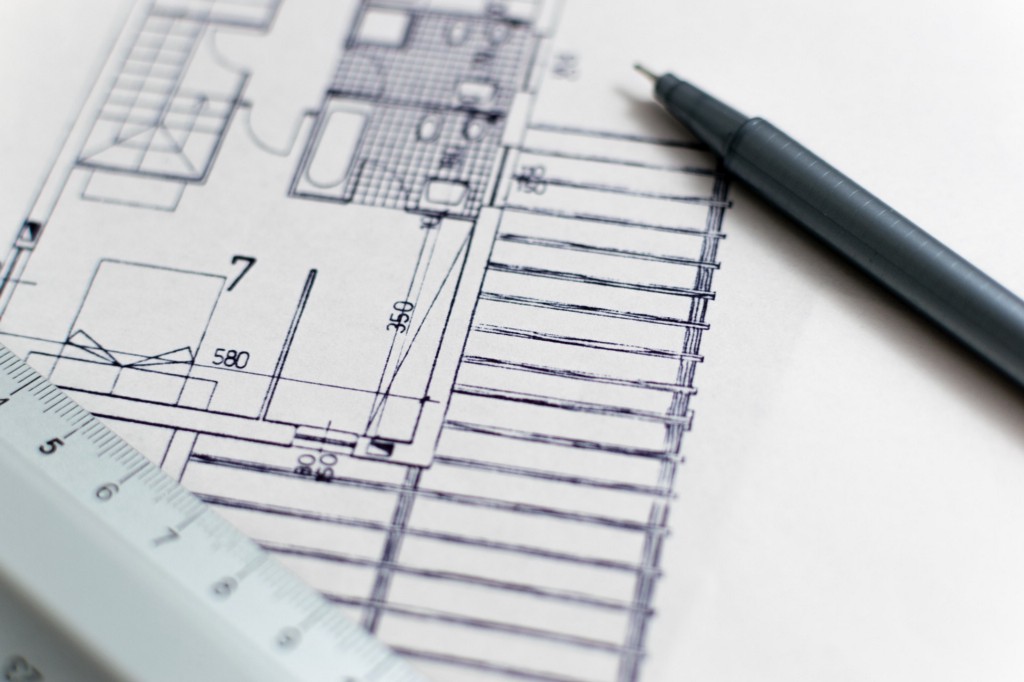

If you want to renovate your home, now is the time

The area surrounding the Victory and Timber Lakes developments in Monroe Township could be on the receiving end of a facelift.

BPC at Whitehall Gardens, LLC plans to build 224 age-restricted, over-55 single family dwellings in the area surrounding Victory and Timber Lakes and the Whitehall Elementary School. Because the development is in close proximity to the school, it was important to restrict the new development to people over the age of 55, as this restriction won’t have an impact on the school.

Council Vice President Joe Marino said this was taken into consideration when negotiating with the builder.

“We looked at a few different things,” he said. “Whitehall school could be impacted if we put in townhomes. What would we have to add on? Would we have to do an addition? It could lead to raising taxes, asking for a bond referendum.”

When the builder agreed to build an over-55 community they wanted a five-year tax abatement, which means they would pay no taxes the first year, 20 percent of taxes the second year, 40 percent in year three, 60 percent in year four, 80 percent in year five and full taxes in the sixth year.

For the property of the development, they won’t pay anything in the first year, in the second year they’ll receive a financial assessment and will pay an estimated $300,000 in taxes. This goes up to $600,000 in year three, $900,000 in year four, and $1.3 million in year five, according to a financial report stated by Marino.

“The caveat is a portion goes to the county and schools but it doesn’t affect the school,” Marino said.

It was important to council that the builder is held to a timeline. When they agreed to the abatement, a seven-year cap was put on it.

“We didn’t want to be strung out for more than seven years,” Marino said. “If it was indefinite, he could build as many as he’s selling. We want to make sure that we keep this project moving.”

This means someone who buys a one of the homes has to do it within seven years of the home being built. If they purchase it in the eighth year, they wouldn’t qualify for the abatement. If a buyer is using a mortgage to purchase the house, they need to qualify without the abatement, Marino added.

With a new development coming to the area, council wanted to include the surrounding areas — namely Victory and Timber Lakes — with a chance to spruce up their respective communities.

According to Marino, portions are under a rehabilitation area and could qualify for an abatement of their own for renovations and upgrades on their homes.

“If people decide they want to put siding on their house, upgrade or renovate their homes, they can get a five-year abatement on their improvements,” Marino said.

If a homeowner wants to put an addition on and they meet zoning requirements, they can add up to 30 percent of square footage to qualify for the abatement.

Marino suggested residents apply for the tax abatement prior to starting construction. The application can be found at the municipal building in the clerk’s office.

The abatement will only apply to the new assessed value. For example, if your annual taxes are $5,000 per year and the renovation raises them to $7,000 per year, the abatement will only affect the $2,000 per year difference.

“It gives incentives for existing homeowners who are thinking about renovating their homes,” Marino said. “With a new neighborhood it could spur investment to come down into that area. We know this neighborhood’s coming so we want existing communities to benefit from this.”